Biden’s Anti-Inflation Vainglory

Not one of the individuals with a proper constitutional grant of power over monetary policy was present at the parley this afternoon at the White House.

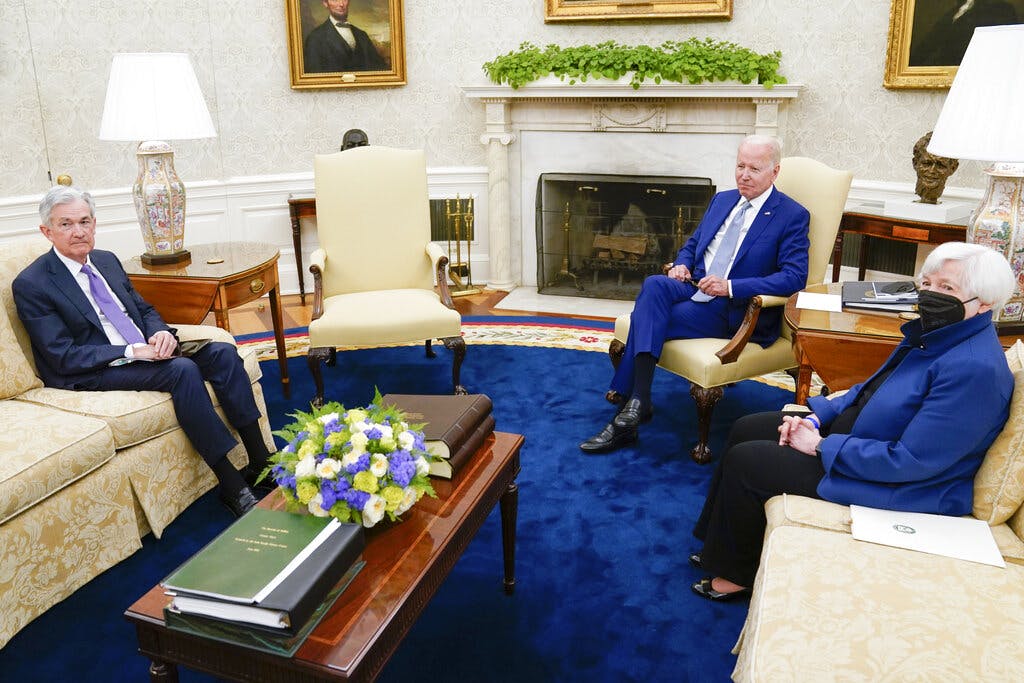

It’s no doubt too much to hope that we’ve suffered the last editorial from the Democratic newspapers in respect of the so-called independence of the Federal Reserve. The carpeting by President Biden of the central bank chairman Jerome Powell and Treasury Secretary Yellen should put paid to all the pretensions. Then again, too, it’s less clear that it will lead to the successful conquest of inflation.

We say that because not one individual with a proper constitutional power over monetary policy was present at the parley this afternoon at the White House. The president might have the sole executive power to take care that the laws in respect of monetary policy are faithfully executed. It’s only the Congress, though, that possesses the actual monetary powers that the Constitution grants our government. No legislators were present.

No doubt this will be seen as pecksniffery, but just to mark the point: One hundred percent of the monetary powers granted to our government are granted to Congress. It has the power to coin money and regulate the value thereof, and of foreign coin, and to fix the standard of weights and measures. It has the sole power to tax, to authorize the withdrawal of money from the treasury, and to borrow money on the credit of the United States.

We mark the point because all this jawboning about the independence of the Federal Reserve is constitutional malarky, to use President Biden’s favorite epithet. There might be some logic to keeping the central bank independent from the executive branch — at least there has been since the 1950s an informal accord that reserves to the White House debt management and to the Federal Reserve monetary matters.

Monetary policy, though, is a separate and enumerated power belonging to Congress. It is vainglorious of Mr. Biden to suggest that he is going to lead a campaign against inflation, though it was right generous (and a scoop) of the Wall Street Journal’s editorial page to give him space to boast of his intentions, as it did in its hallowed columns this morning. Nor did he offer any of the strategies that will be required.

These are all what, during the Reagan years, were known as supply-side measures. These are reductions in top marginal tax rates to spur investment and production, with higher interest rates to keep the economy from spinning out of control (see Paul Volcker). We need vast deregulation of industry and energy and a reopening of America’s pipelines and oil wells and a campaign of drill, baby, drill.

That said, for a more strategic campaign against inflation, we need a restoration of honest money — with a definition in law in terms of specie. The last attempt at that ended 51 years ago with the abandonment of the Bretton Woods gold exchange standard. That default begat the era of fiat money, with all its troubles. No White House powwow with the president and his appointees can address those problems without Congress.