Redistricting Wars Kicked Off By Trump Poised To Linger Well Into 2028 Election Cycle

By MATTHEW RICE

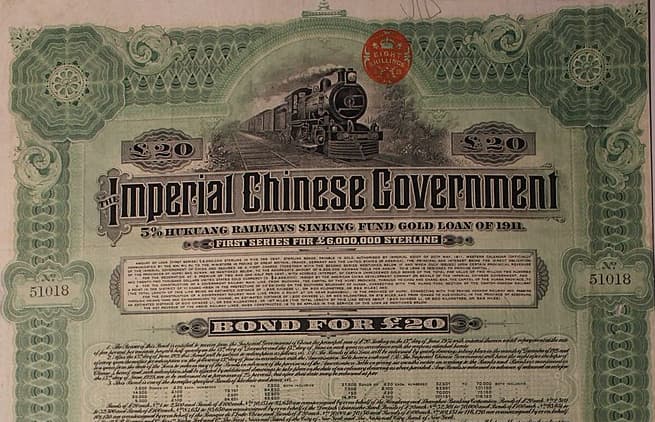

|American bondholders say they are owed as much as $1 trillion from the regime at Beijing, which inherited the obligations of the Chinese government the communists overthrew.

Already have a subscription? Sign in to continue reading

By MATTHEW RICE

|

By LUKE FUNK

|

By WILL FRIEDWALD

|$0.01/day for 60 days

Cancel anytime

By continuing you agree to our Privacy Policy and Terms of Service.

By MATTHEW RICE

|