Love and Resilience Derived From ‘Monsters’ and Martial Arts

By ELYSA GARDNER

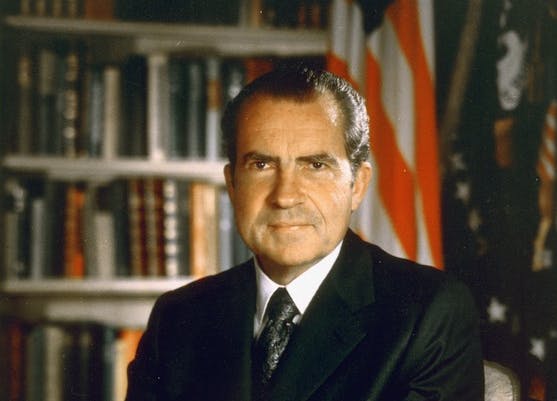

|Lest one suppose that five percent inflation is no big deal, look at the numbers leading up to August 15, 1971, when President Nixon slammed shut the gold window and ushered in the age of stagflation.

Already have a subscription? Sign in to continue reading

By ELYSA GARDNER

|

By ELYSA GARDNER

|

By NOVI ZHUKOVSKY

|$0.01/day for 60 days

Cancel anytime

By continuing you agree to our Privacy Policy and Terms of Service.