Is the Supreme Court Going To Pre-Empt a Wealth Tax?

A farsighted couple that invested in a company in India could put paid to a left-wing scheme to tax unrealized gains.

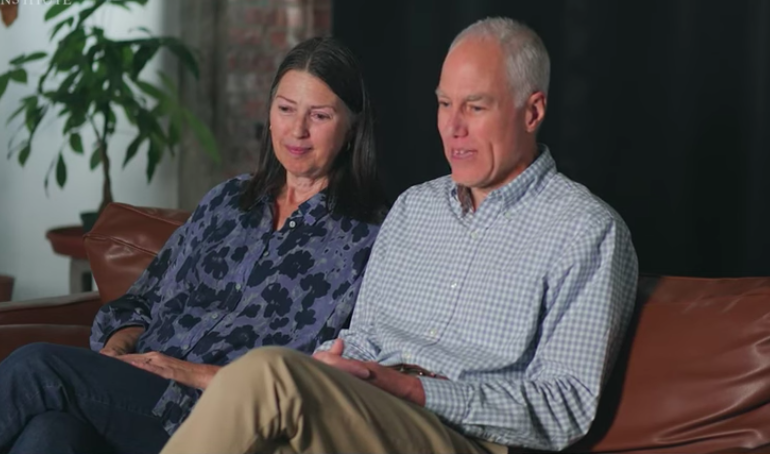

One of the great things about the Constitution is that it’s a game everyone can play — sometimes with historic results. The latest instance could be a case in which America has been haled by a Washington state couple, Charles and Kathleen Moore, who invested in an Indian farm equipment company. They have just gained a hearing at the high court that could eventually result in the Nine issuing a pre-emptive ban on a wealth tax in America.

Our Russell Payne, who spotted this story, writes that while the case “centers around a relatively obscure federal tax policy,” it could have large implications. The dispute is over, he reports, a “one-time repatriation tax that is levied on money that American companies make overseas, if and when it is brought back into America.” Yet in this case the Moores were socked with huge tax bills even though they hadn’t received any return on their investment.

The IRS, pointing to a so-called “Mandatory Repatriation Tax,” told the Moores that they owed taxes on the Indian company’s profits — which were reinvested in the company — “even though they hadn’t received a penny,” the couple say in their pleading to the Supreme Court. This is how the case bears on the possibility of a so-called wealth tax, which would similarly try to tax Americans on the value of their investments, even before the property is sold.

This flies in the face of more than 100 years of precedent, the Moores say, arguing that the repatriation tax is unconstitutional. They rely on a Supreme Court case from 1920, Eisner v. Macomber, which found that only “realized gains” — like profits from the sale of an asset — are taxable as income. So, Mr. Payne explains, “even if an investment rises in price, the increased value would not be taxable until its owner sold the property.”

That precedent, though, is a barrier to the schemes for a so-called “wealth tax” put forward by President Biden and Senators Warren and Wyden, Mr. Payne observes, “all of whom have floated the idea of taxing assets held by the richest Americans.” One such proposal is a tax on “unrealized capital gains,” as Mr. Biden has suggested, forcing stock and property owners to pay levies on the growth of their investments, even before they sell them.

The liberal press can’t wait to traduce these property rights. “Despite the protests of some billionaires,” Vox reports, “this longstanding progressive agenda item” — the wealth tax — “is becoming increasingly mainstream.” Vox laments that “the power and influence that the ultra-wealthy wield comes from the value of the assets they currently own.” Yet, once enacted, what would stop a wealth tax from eventually coming after middle-class taxpayers?

It’s a signal of the left’s interest in this case that liberals like Senator Durbin are trying to put a thumb on the scales of justice in this case, getting Justice Samuel Alito to recuse himself from Moore. Mr. Durbin gripes that the justice was interviewed by one of the lawyers in the case for two opinion essays in the Wall Street Journal. It’s one of the flimsiest and most self-serving calls for recusal ever to be flung at the court and obnoxious enough to be contempt.

The Constitution, meanwhile, is a bulwark against a wealth tax. Article I, Section 9 forbids any “direct tax” on Americans “unless in proportion” among the population of the states. This held at bay the federal income tax until the ratification of the 16th Amendment, which allows Congress to tax incomes “without apportionment among the several States.” Yet there is no such dispensation for a direct tax on Americans’ hard-earned wealth.