From Log Cabins and Empty Lots, Presidential Origins Manifest America’s Destiny

By DEAN KARAYANIS

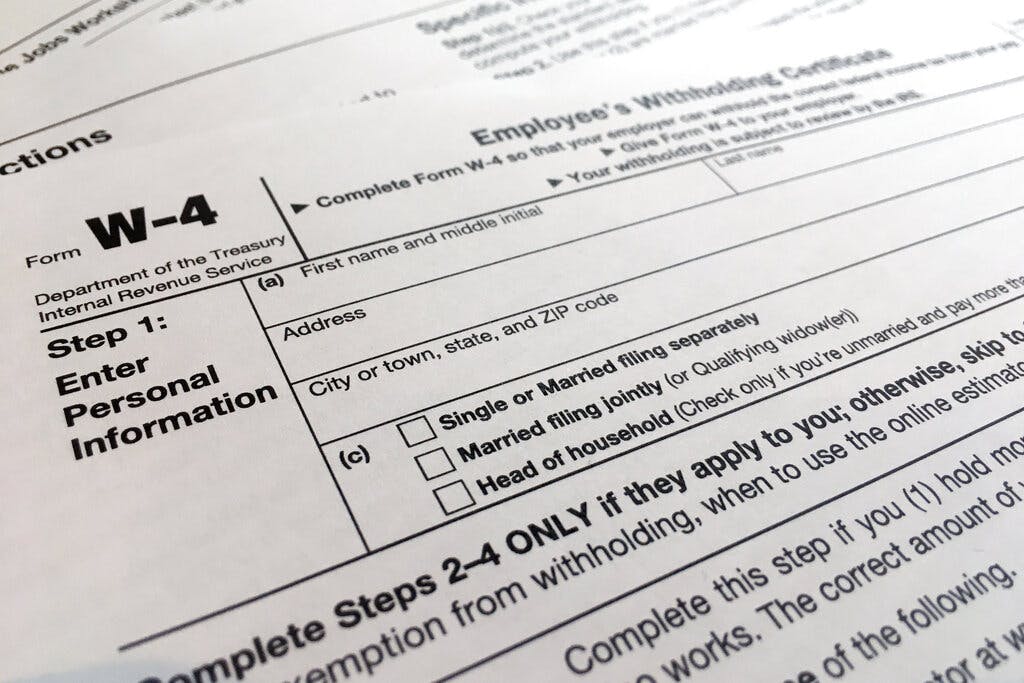

|It looks like Blue State governors will have to turn elsewhere for relief on the high taxes plaguing their residents.

Already have a subscription? Sign in to continue reading

$0.01/day for 60 days

Cancel anytime

By continuing you agree to our Privacy Policy and Terms of Service.

By DEAN KARAYANIS

|

By CONRAD BLACK

|

By JOTAM CONFINO

|

By SHARON KEHNEMUI

|

By MATTHEW RICE

|

By GARY GASTELU

|

By SHARON KEHNEMUI

|

By ELYSA GARDNER

|