Netanyahu Envisions New Mideast Alliances

By BENNY AVNI

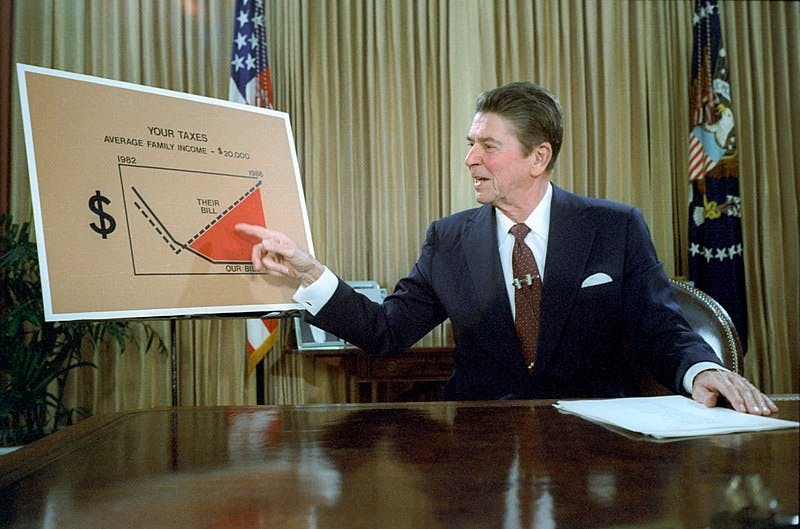

|The president is ignoring the lessons of the 1970s and pushing a budget that will worsen inflation.

Already have a subscription? Sign in to continue reading

By BENNY AVNI

|

By MATTHEW RICE

|

$0.01/day for 60 days

Cancel anytime

By continuing you agree to our Privacy Policy and Terms of Service.

By HOLLIE McKAY