The Fed: A ‘Preposterous Offspring of Ignorance and Unreason’

President Trump raises hackles with talk of proposals to ‘erode the Federal Reserve’s independence,’ but a reappraisal of the Fed itself is long overdue.

President Trump is “alarming experts and investors,” the Hill says, after a Wall Street Journal scoop that the GOP front-runner is “quietly drafting proposals” to “erode the Federal Reserve’s independence” if he returns to the White House. The Journal reports that Mr. Trump and his advisers are weighing “how aggressively to challenge the central bank’s authority.” Yet, in our view, a reappraisal of the Fed itself in its first century-plus is overdue.

The point to mark in the wake of the Journal’s report is that nowhere does the Constitution ordain that America’s monetary policy be independent of anyone. On the contrary, 100 percent of the monetary powers of the United States are granted to the Congress — the most political branch of the entire constitutional contraption. The ones to worry about are those trying to isolate monetary powers from the political process.

To underscore the point, the taxing power goes to Congress, along with power to “regulate commerce,” the power “to borrow money on the credit of the United States,” and the power “to coin money, regulate the value thereof, and of foreign coin.” So, too, the power to “fix the standard of weights and measures.” Acting on these powers, Congress put America on a specie standard, in which paper money was convertible into gold or silver, from its earliest days.

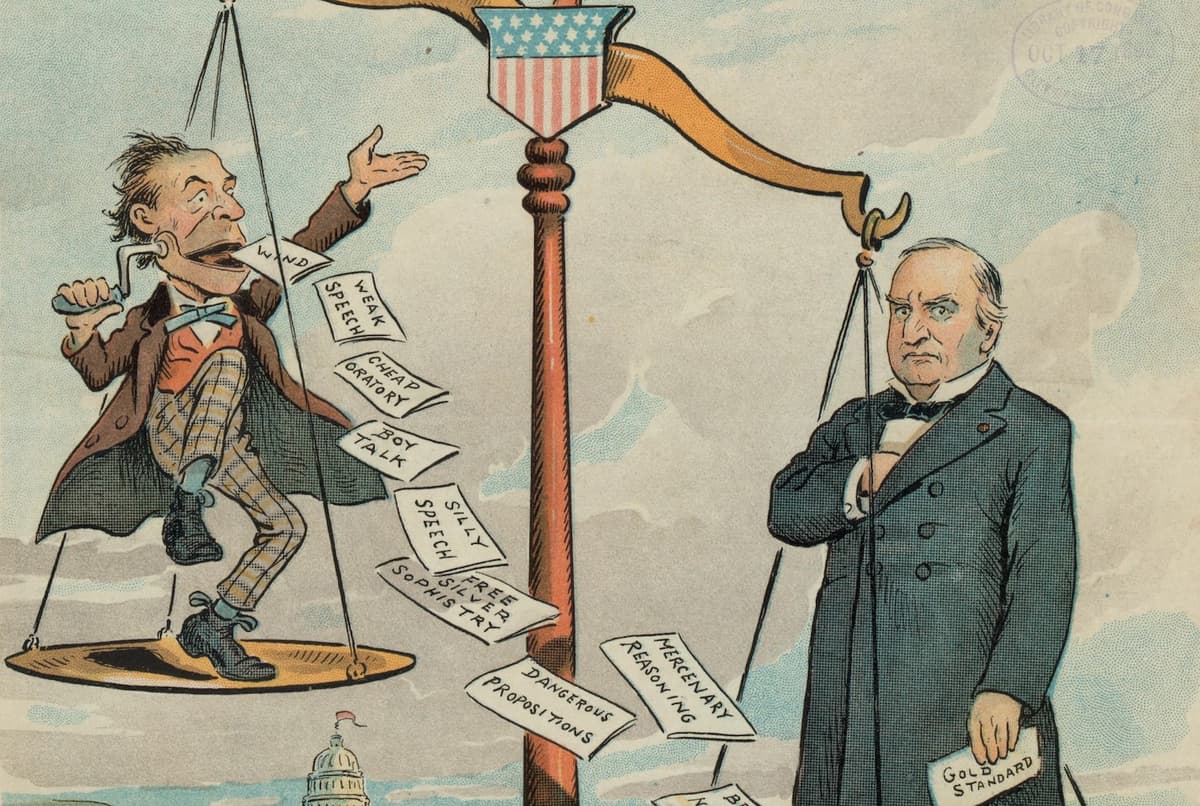

Monetary debates were raucous. Most Democrats — The Great Cleveland was an exception — backed inflationary policies like “free silver.” Republicans favored a gold standard that kept the dollar’s value. It climaxed in the 1896 election when inflationist William Jennings Bryan faced Wm. McKinley. The GOP’s win teed up the Gold Standard Act of 1900, pledging America to an honest dollar that held, in the years 1879 to 1913, annual inflation to but 0.1 percent on average.

In 1913, though, with Democrats controlling the White House and both houses of Congress, monetary policy took a turn. At President Wilson’s urging, Congress surrendered its own powers over money. Instead these powers were delegated to a brainstorm of the Progressive movement, the Federal Reserve. The hope was that the new central bank, as historian Edwin Vieira Jr. puts it, would achieve the “scientific management of currency and credit.”

The New York Sun then decried the scheme as a “preposterous offspring of ignorance and unreason,” fearing the proposed bank would have “absolute control” of financial policy and was “covered all over with the slime of Bryanism.” In response to such criticism, Congress amended the Federal Reserve Act to say that nothing in the law would interfere with the dollar’s convertibility under the Gold Standard Act. Within a generation, that would ring hollow.

It might have been one thing if the creation of a “scientific” central bank had helped maintain a sound currency, though every member of the Fed is sworn to the Constitution. Since the Fed’s creation, though, the value of the dollar has plummeted to its current nadir of less than a 2,300th of an ounce of gold from a 20.67th of an ounce of gold, the rate enshrined in the Act of 1900. The Fed’s custody of the dollar, in short, has been a history of debasement.

Which brings us back to reports of Mr. Trump reassessing the Fed’s autonomy. Senator Cramer is among those fretting that the Fed’s “independence is critical” to handling monetary policy in “an unbiased, nonpolitical way.” Senator Tillis says his concern over the Fed is “the next 50 years, not the next four, and independence is important.” These solons seem to forget the power the Framers meant the people’s elected representatives to regulate the value of our dollar.

All the more reason, then, to welcome Mr. Trump’s reported initiative. It would be a great thing were it to open a debate on the so-called “independence” of the central bank that has such a track record. This is not to say the president should be unilaterally setting monetary policy, as some fear in light of the Journal’s report. The monetary power belongs to Congress, and the moment is ripe for the legislature to reclaim its power — as the Constitution ordains.