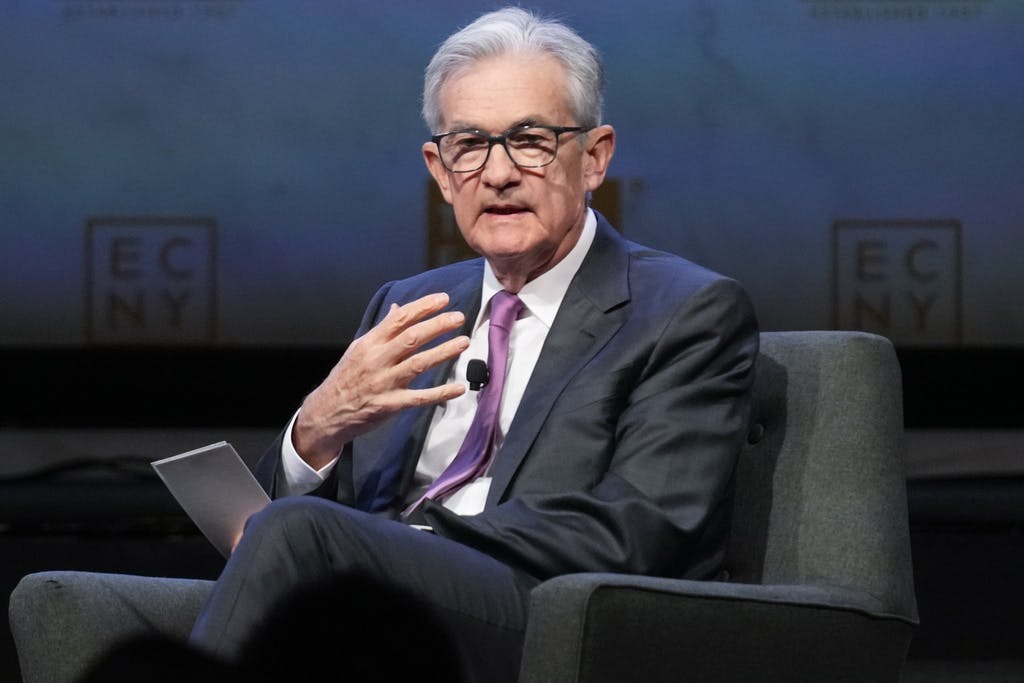

The Federal Reserve Admits It’s Stumped

‘We certainly have a very resilient economy on our hands,’ Jerome Powell laments.

Just in time for Halloween, the Fed chairman, Jerome Powell, is spooking markets, warning that the fight to curb inflation “will likely require a slower-growing economy and job market,” as the AP puts it. “We certainly have a very resilient economy on our hands,” Mr. Powell laments in remarks today, calling its steady growth “a surprise.” It’s even scarier to see the Fed apparently relying on a long-outmoded model, the Phillips Curve, to guide its plans.

The curve, named after the late New Zealand economist William Phillips, traces a link between unemployment and prices, associating more joblessness with lower inflation. Yet most economists now agree the curve no longer has much use in shaping fiscal or monetary policy, in part because it’s been shown that low unemployment can coincide with low inflation, as America learned, say, under policies that prevailed during the Trump administration.

Even so, as far back as 2018, when the head of the St. Louis Fed, James Bullard, was asking “Who Killed The Phillips Curve?”, and noting “there isn’t much of a relationship anymore between labor market performance and inflation,” Mr. Powell couldn’t quite accept the end of the venerable economic model. “I wouldn’t say it’s dead,” Mr. Powell observed. “It might be resting.” NPR observed that the curve is “still invoked during the debates within the Fed.”

So it seems, like a kind of unkillable horror-film villain, this outmoded model continues to hold our central bankers in its thrall, oblivious to the pain they are attempting to inflict on working Americans, more of whom, the Phillips Curve says, need to be thrown out of work in order to tame the inflation spiral. Lost in this ghoulish fog is any awareness on the part of the Fed of its own role, along with federal overspending, in sparking today’s inflation.

After all, the Fed has been, over the past 15 years, on a course of reckless monetary experimentation, snapping up some $9 trillion in assets in an effort to stimulate the economy and keep interest rates artificially low. This Quantitative Easing drive helped spark an asset bubble and now, economists are warning, has put taxpayers on the hook for $1.6 trillion in lost Treasury revenue, as these columns have noted.

Mr. Powell, too, was a cheerleader for President Biden and the Congressional Democrats who in early 2021 voted to inject trillions of stimulus dollars into the already-recovering economy. That cataract of over-spending helped set the stage for the wave of inflation that is still plaguing the economy and thieving from Americans’ savings. Worse, the Fed chief was among those parroting the White House attempt to brush off rising prices as “transitory.”

Now, faced with a seemingly irrepressible economy that refuses to follow the downward path suggested for it by the Phillips Curve, Mr. Powell appears to be stumped. “A range of uncertainties, both old and new, complicate our task,” is how he explained it this morning. That’s FedSpeak for having no idea what’s going on. Pressed on the economy’s resilience, Mr. Powell hazarded that maybe interest rates “haven’t been high enough for long enough.”

That’s an ominous thought, the Financial Times’ Gillian Tett reports, since the economy is already groaning under interest rates that were hiked sharply in the past 18 months. That has so far sparked a banking crisis and the crash of Silicon Valley Bank. The Fed’s own balance sheet shows signs of insolvency, clear-eyed economists have warned. Ms. Tett notes that some $2 trillion in corporate debt “must be refinanced in the next two years” at today’s higher rates.

Ms. Tett concludes that central banks, faced with these forebodings, are likely to jettison their target of two percent inflation, or at least “tacitly downplay the goal,” as she puts it. As for Mr. Powell, it would be nice to see the Fed take responsibility for its role in this current inflationary debacle, and make a move back toward honest money, rather than trying to throw more Americans out of work in the name of a moribund economic model.