Cincinnati Considers Marijuana Tax To Fund Reparations Program for Residents in Predominately Black Neighborhoods

By LUKE FUNK

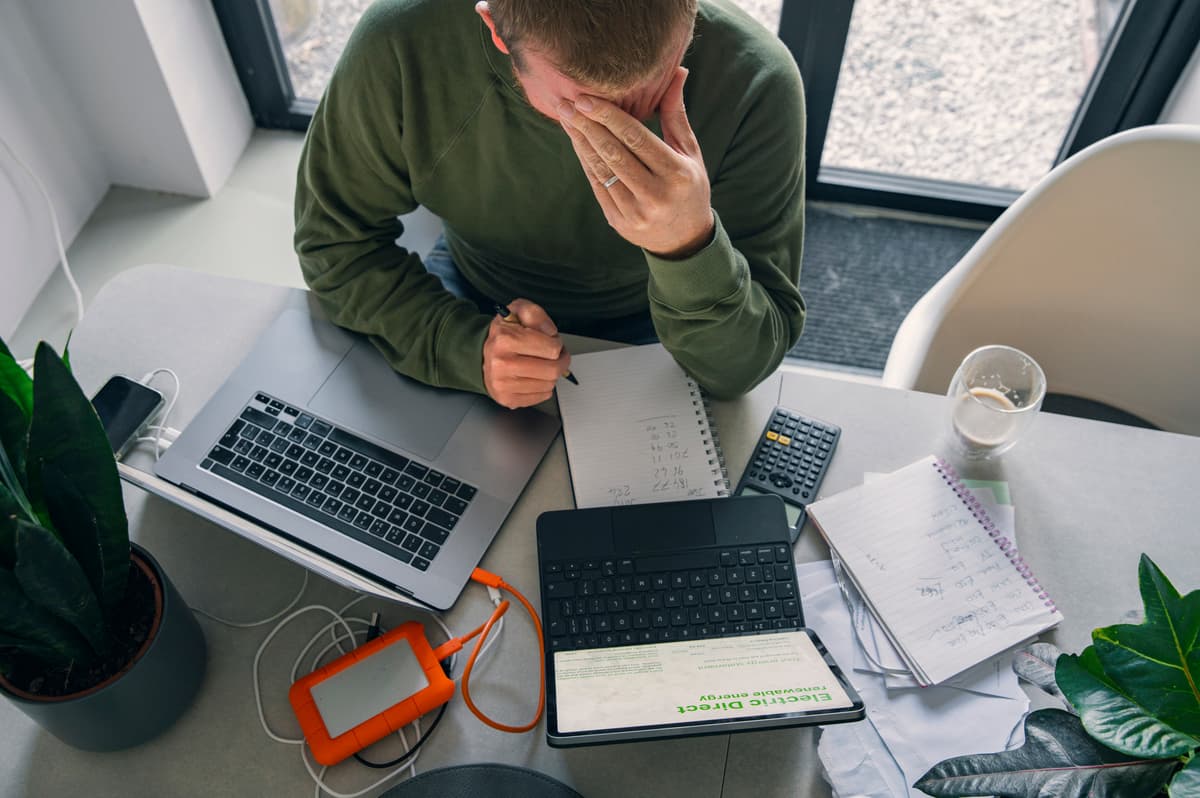

|Under America’s fiat money regime, a six-figure salary is no longer ‘a milestone for success but merely the bare minimum for staying afloat,’ Fortune reports.

Already have a subscription? Sign in to continue reading

By LUKE FUNK

|

By LUKE FUNK

|

$0.01/day for 60 days

Cancel anytime

By continuing you agree to our Privacy Policy and Terms of Service.

By NEWT GINGRICH

|