The Tin Pot Dollar

Measuring the value of our money compared to various other fiat currencies is a fool’s errand.

The headline this morning atop the Drudge Report — “Dollar is King / Best Month in Decade” — certainly got our attention. It turns out to refer to a story in the Bloomberg in respect of how America’s fiat currency, which we call irredeemable electronic paper ticket money, compares to other fiat currencies like the yen, the euro, the won, the yuan, and other scrip. It is devoid of reference to the constitutional specie of gold or silver.

Or to the condition of the Federal Reserve system that issues the notes that we use for currency. The latest number of Grant’s Interest Rate Observer is just out with a devastating editorial calling for the central bank to be examined. Its $8.5 trillion worth of fixed-income assets, Grant’s notes, are leveraged 217:1. Grant’s reports, too, on a new analysis suggesting that, for the just-ended quarter, the central bank will likely show a loss of half a trillion dollars.

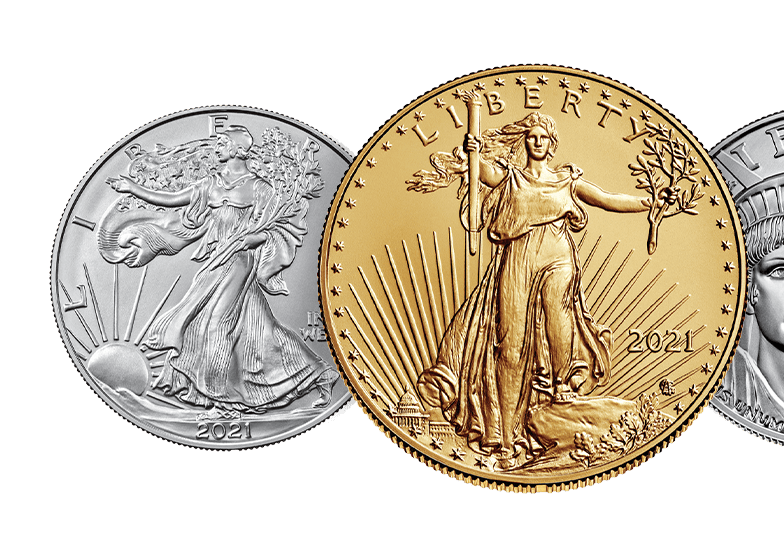

It is true that the value of the dollar has lately gained nearly five percent, having risen to an 1,885th of an ounce of gold from a 1,978th of an ounce of gold in mid-April. That the dollar is valued at either one of those levels, however, represents, in the context of history, a shocking scandal — a failure on the part of the United States Congress that possesses the Constitutional grant of power to coin money and regulate the value thereof.

We keep marking this point because measuring the value of our money compared to various other fiat currencies is a fool’s errand. It’s not that purchasing power parity is a useless concept, but it is not going to lead to price stability in and of itself. In our view that is going to require a genuine reform of our monetary system and a return to some structure that defines the dollar as a matter of law in terms of specie.

This is why we pay attention to the growing signs of ferment on this head in the Congress. Our most recent editorial on this was about the plan of Congressman French Hill, a Republican of Arkansas, to introduce a measure that would end the so-called “dual mandate” of the Federal Reserve. That is, it would strip the Fed of the requirement to pursue full employment and return the central bank to the sole mission of stable prices.

We, and no doubt Congressman Hill know, this won’t happen under Democratic control of the House or Senate, but it’s the kind of ferment that suggests at least some of our solons are on to this issue. And given that the Republicans have at least a hope of returning to the majority after the November elections, it’s not too soon to start thinking about the particulars of a possible agenda for serious monetary reform.

Our own first choice would be the creation by Congress of a proper monetary commission to study the issue and recommend a course. One of the first things President Reagan did upon taking office was to appoint members to a commission to study the role of gold in financial systems. That effort failed, alas, in no small part due to the fact that its staff director was Anna Schwartz, who was at the time opposed to a gold standard.

The Reagan-era commission’s fate is a cautionary tale for today’s monetary reform advocates: the preference for easy money is entrenched in our economic system. The 1980 Republican platform had urged “the restoration of a dependable monetary standard.” Despite that, the commission was, Murray Rothbard later observed, “packed with lifelong opponents of gold who buried any call for a hard currency.”

Recent Republican platforms have renewed the call for a commission to weigh “the feasibility of a metallic basis for U.S. currency.” That takes into consideration the historic fact that both silver and gold have served as the basis of value for the constitutional dollar. To translate that platform rhetoric into concrete public policy, nevertheless, would be a political challenge for monetary reformers.

So the dollar might be “king,” but only in the relative sense. Its anemic value today reminds that the reform has never been more timely. Even as headlines appear in the press touting the ostensible strength of the dollar, Congress cannot dodge the broader question of what constitutes value. The dollar might well be king of today’s debased global currencies, but it wears a tin pot for a crown.