A One Big Beautiful Bill Deficit Trumpian Primer

The current policy cost of extending the 2017 Trump tax cuts should be zero.

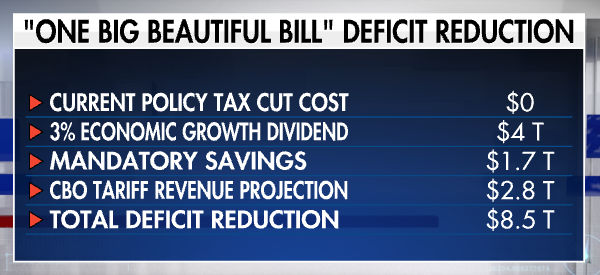

There’s a lot of numbers flying around, but let me just review the One Big Beautiful Bill scorecard. Because I know there are all these numbers flying around the last couple of days, so I’m going to try do this as easily as possible so people can follow.

Let us start with this table. It’s a super-duper table.

The current policy cost of extending the 2017 tax cuts should be zero.

Why should the cost be zero? Because they actually produced more revenues, $2.3 trillion in more revenues than the Congressional Budget Office originally estimated, over the past seven years. So current policy shouldn’t be scored. The deficit impact should be neutral.

Now, I believe there will also be a growth dividend. Which may be debatable, but if I plug in 3 percent GDP growth instead of the CBO’s lowball 1.8 percent, then I actually get a $4 trillion worth of additional revenues for purposes of deficit reduction.

Now it gets a little easier. I plug in a $1.7 trillion mandatory savings, which even the CBO agrees on.

And then, thanks to a new CBO report, I plug in tariff revenues of $2.8 trillion over the next ten years. That’s, by the way, assuming a 10 percent universal baseline tariff.

Now, much as I like the CBO estimate and their acknowledgement of what’s happening already in the first half of this year, the CBO unfortunately won’t count it toward the One Big Beautiful Bill because Congress didn’t appropriate it. But it’s there, and it will slash the deficit, and we will sell a lot fewer bonds.

So, add all that up, and I come up with $8.5 trillion in deficit reduction over the 10-year planning period. That’s much better than CBO’s $2.4 trillion deficit increase. An eight and a half trillion-dollar reduction in the deficit — against the CBO’s two and a half trillion-dollar increase.

Now look, you can play with these numbers interactively. If you lower the growth dividend, let’s say to 2.6 percent, you’d probably lose up to $2 trillion in revenues and deficit reduction.

Or if you want to use the CBO’s dreary 1.8 percent growth, you’d lose the whole $4 trillion in additional revenues and debt reduction. You’d still come out ahead on the deficit reduction scorecard, but just not by as much.

Yet, importantly, the GOP will prevent a $4 trillion tax hike, which would be catastrophic for the economy. And the GOP will implement the biggest welfare reform package — that is to say, workfare, not welfare — in at least thirty years, going back to the Clinton-Gingrich days in the 1990s.

If you disagree with some of my assumptions, I get it.

The one thing that I can just tell you is that extending the 2017 tax cuts is not going to cost anything.

And, as even the CBO agrees, the mandatory savings are significant — and the tariff revenues are a pleasant surprise, and will be an additional way of financing the government in the future.

From Mr. Kudlow’s broadcast on Fox Business Network.