Florida Freeze Prompts Roundup of Cold-Stunned Iguanas as Thousands Fall From Trees

By LUKE FUNK

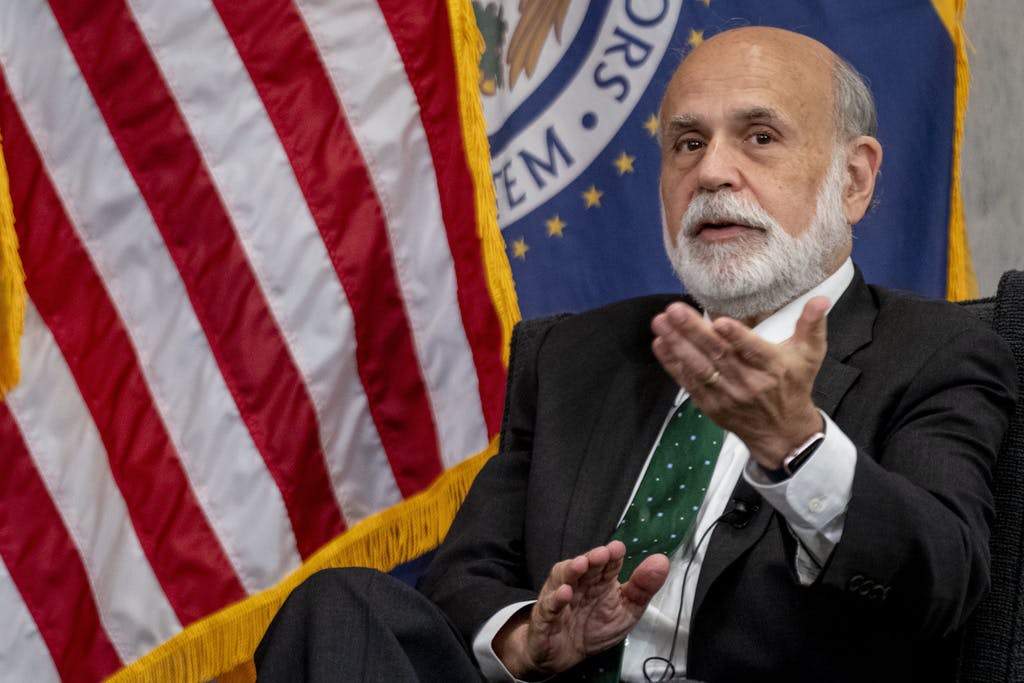

|The former Fed chairman and newly minted Nobel laureate fears Congress might try to impose a lower inflation target on the central bank.

Already have a subscription? Sign in to continue reading

$0.01/day for 60 days

Cancel anytime

By continuing you agree to our Privacy Policy and Terms of Service.

By THE NEW YORK SUN

|