Alabama Lawmakers Consider Bill That Would Make It a Felony To Intentionally Disrupt a Church Service

By BRADLEY CORTRIGHT

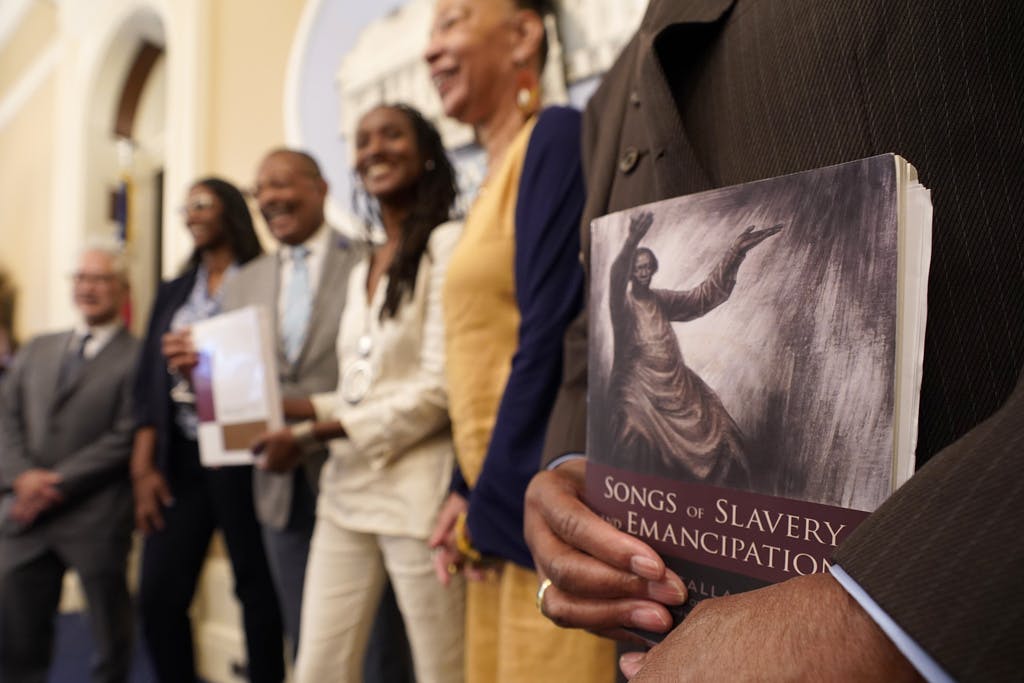

|As Governor Hochul’s reparations commission meets this year, one key question will be the extent to which the private sector will be held responsible for early ties to slavery.

By BRADLEY CORTRIGHT

|

By WILL FRIEDWALD

|

By NOVI ZHUKOVSKY

|

By NOVI ZHUKOVSKY

|

By DANIEL EDWARD ROSEN

|

By MATTHEW RICE

|

By JOSEPH CURL

|

By BRADLEY CORTRIGHT

|Already have a subscription? Sign in to continue reading

$0.01/day for 60 days

Cancel anytime

By continuing you agree to our Privacy Policy and Terms of Service.