Florida Freeze Prompts Roundup of Cold-Stunned Iguanas as Thousands Fall From Trees

By LUKE FUNK

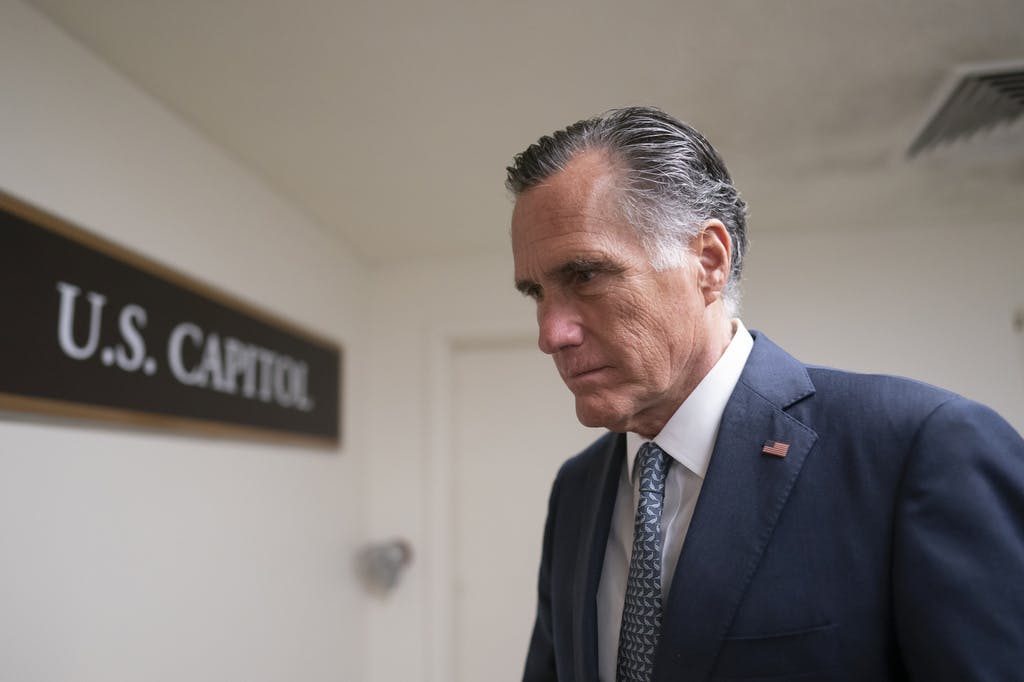

|A small but influential wing of the GOP has a passion for supposed bipartisanship — inevitably ending up supporting higher taxes, more government, bigger bureaucracy, more regulations, and slower growth.

Already have a subscription? Sign in to continue reading

$0.01/day for 60 days

Cancel anytime

By continuing you agree to our Privacy Policy and Terms of Service.

By THE NEW YORK SUN

|