Fed Raises Key Rate by Half-Point and Signals More To Come

The central bank anticipates its key short-term rate will reach 5 percent to 5.225 percent by end of next year.

WASHINGTON — The Federal Reserve reinforced its inflation fight Wednesday by raising its key interest rate for the seventh time this year and signaling more hikes to come. Yet the Fed announced a smaller hike than it had in its past four meetings at a time when inflation is showing signs of easing.

The Fed boosted its benchmark rate a half-point to a range of 4.25 percent to 4.5 percent, its highest level in 15 years. Though lower than its previous three-quarter-point hikes, the latest move will further increase the costs of many consumer and business loans and the risk of a recession.

The policymakers also forecast that their key short-term rate will reach a range of 5 percent to 5.25 percent by the end of 2023. That suggests that the Fed is prepared to raise its benchmark rate by an additional three-quarters of a point and leave it there through next year. Some economists had expected that the Fed would project only an additional half-point increase.

The prospect of higher-than-expected borrowing rates disappointed Wall Street. Investors immediately sent stock prices falling.

The latest rate hike was announced one day after an encouraging report showed that inflation in the United States slowed in November for a fifth straight month. The year-over-year increase of 7.1 percent, though still high, was sharply below a recent peak of 9.1 percent in June.

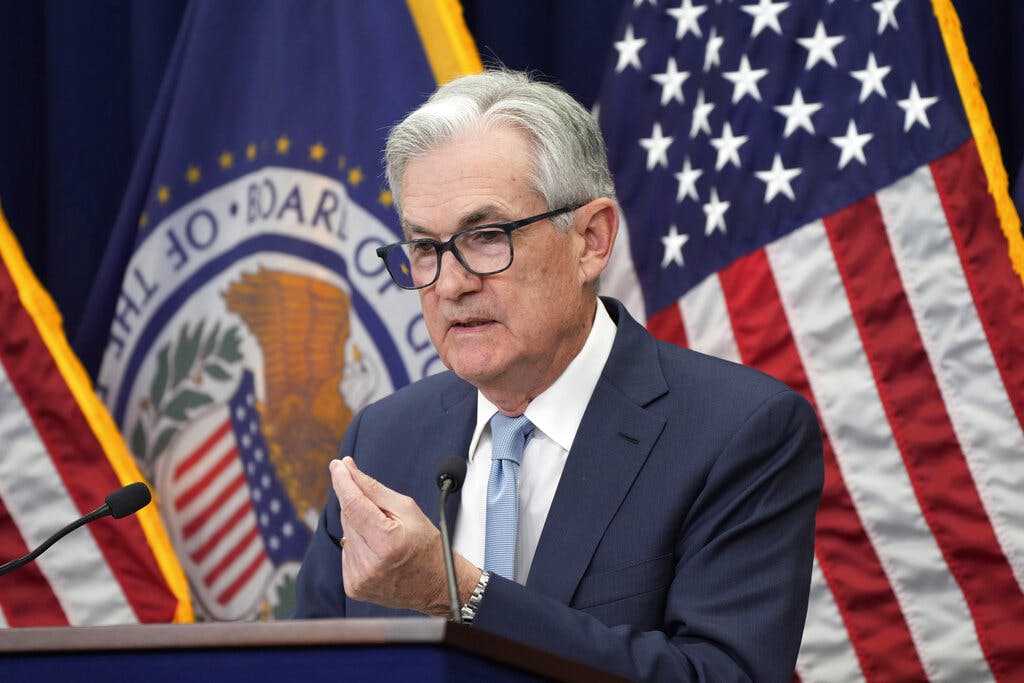

“The inflation data in October and November show a welcome reduction,” Chairman Jerome Powell said at a news conference. “But it will take substantially more evidence to give confidence that inflation is on a sustained downward path.”

In its updated forecasts, the Fed’s policymakers predicted slower growth and higher unemployment for next year and 2024. The unemployment rate is envisioned to jump to 4.6 percent by the end of 2023 from 3.7 percent today. That would mark a significant increase in joblessness that typically would reflect a recession.

Consistent with a sharp slowdown, the officials also projected that the economy will barely grow next year, expanding just 0.5 percent, less than half the forecast it had made in September.

In recent weeks, Fed officials have indicated that they see some evidence of progress in their drive to defeat the worst inflation bout in four decades and to bring inflation back down to their 2 percent annual target. The national average for a gallon of regular gas, for example, has tumbled to $3.21 from $5 in June.

Many supply chains are no longer clogged, thereby helping reduce goods prices. The better-than-expected November inflation data showed that the prices of used cars, furniture and toys all declined last month.

So did the costs of services from hotels to airfares to car rentals. Rental and home prices are falling, too, though those declines have yet to feed into the government’s data.

And one measure the Fed tracks closely — “core” prices, which exclude volatile food and energy costs for a clearer snapshot of underlying inflation — rose only slightly for a second straight month.

Associated Press