For Republican Tax Cuts, Think Reagan-Trump — Not Nixon-Ford

Senator Thune sets an April 11 deadline for a final agreement in Congress for Trump’s ‘one, big, beautiful’ tax-cut bill.

For Republican tax cuts, think Reagan-Trump — not Nixon-Ford.

Senator Thune, the majority leader, has set an April 11 deadline for a final agreement between House and Senate Republicans on a budget resolution that will form the backbone for President Trump’s “one, big, beautiful” tax-cut bill.

Let’s hope he’s right. Let’s hope both houses meet the deadline. And there’s plenty of work to do.

It’s become fashionable for some conservatives to beat up on the Senate Republicans for going too slow.

Maybe so, but Senator Crapo, the Finance Committee chairman, has been working hard on the “one, big, beautiful” bill.

Numerous senators are working to translate Elon Musk’s DOGE budget savings into at least one and perhaps more rescission packages that would undo spending, by essentially ripping up the check.

There is a Senate budget package for the border, deportations, energy reform, and military increases. And it shouldn’t be too hard to graft Mr. Crapo’s tax-cut plan onto it.

However, the House has a lot of work to do as well.

It’s a miracle that Speaker Johnson got a budget passed, and I’m glad he drew first blood.

But there are a lot of problems with the House budget resolution.

For one, it does not make the Trump tax cuts permanent.

For another, it does not include Mr. Crapo’s current policy baseline, which is an accounting device that makes the tax cuts permanent on a deficit-neutral basis. It was used before by President Obama for permanent tax cuts that need not be re-scored every few years.

Instead, the House has produced a gimmicky linkage between spending cuts and tax cuts. This is a big mistake.

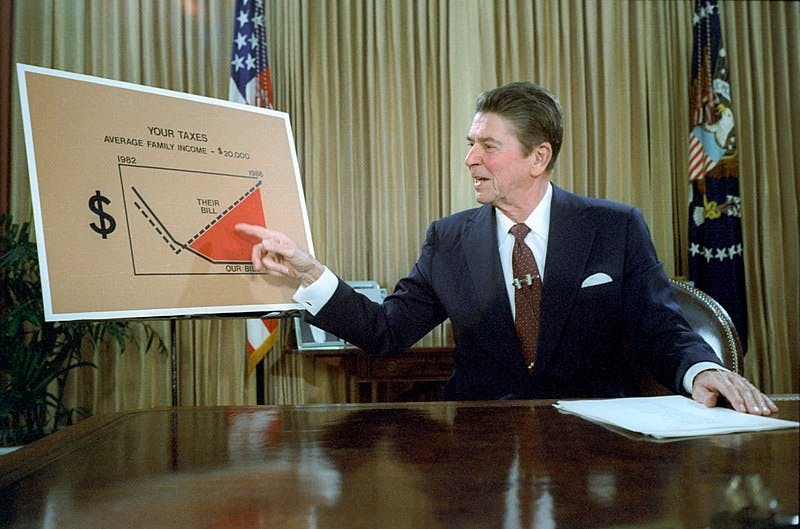

It reminds me of the pre-Reagan years, when Nixon-Ford Republicans always waited to cut the deficit before they cut taxes. And, since they never cut the deficit or spending, they never cut taxes.

Fortunately, Reagan broke that high-tax dogma.

But some House Republicans have fallen back into that tax trap.

Another problem for both the Senate and House Republicans is delivering Trump Tax Cuts 2.0, because the current policy baseline only applies to Trump Tax Cuts 1.0.

Mr. Trump’s promised tax-free tips, overtime, Social Security benefits, a 15 percent “Made in America” corporate tax cut, and 100 percent retroactive expensing for factories — those are all great new policies, but they don’t fall under that rule.

You could put them all together in one bill. That remains to be seen, though.

And it would require some major-league dynamic growth scoring to account for supply-side Laffer Curve revenue growth.

In other words, both Republican houses are still a long stone’s throw away from a tax-cut driven blue-collar boom.

However, in the spirit of Ronald Reagan, watch Mr. Trump seal the deal.

From Mr. Kudlow’s broadcast on Fox Business Network.