Happy Birthday, Laffer Curve — America Needs a Supply-Side Comeback

The power of tax cuts to boost growth and even increase federal revenues is a teaching moment for congressional Republicans.

About 50 years ago Art Laffer drew a convex curve on a napkin to illustrate the power of tax cuts to two senior officials from the Ford administration named Donald Rumsfeld and Dick Cheney.

Unfortunately they didn’t take his advice, and they raised taxes in order to reduce economic demand, which they erroneously thought would conquer inflation. They were wrong.

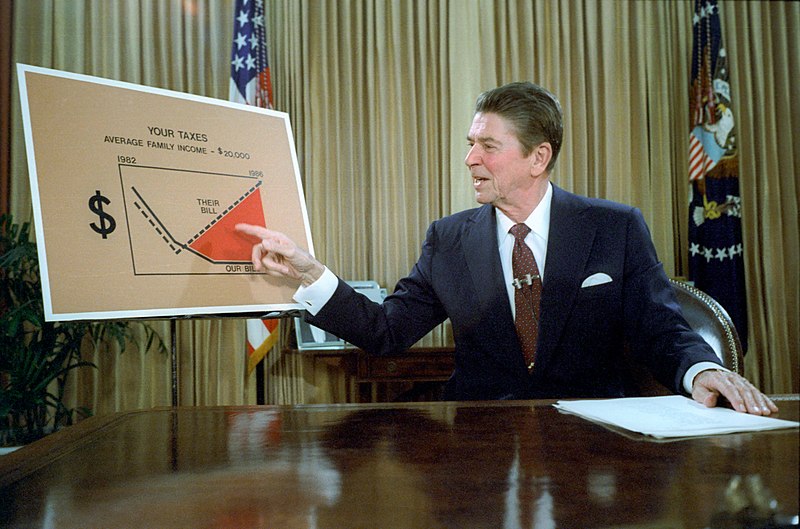

The economy went into a deep recession and inflation wasn’t conquered until Ronald Reagan’s tax cuts and Paul Volcker’s hard money in the early 1980s. Yet Mr. Laffer’s convex curve showed the optimal policy mix for tax revenues and economic growth.

If tax rates were too high, tax revenue would fall. Yet if tax rates were reduced, then both economic growth and revenues would rise.

As historical examples, Mr. Laffer showed the successful Harding-Coolidge-Mellon tax cuts of the 1920s, then the great JFK tax cuts of the 1960s.

Here’s what President Kennedy said: “It is a paradoxical truth that tax rates are too high and tax revenues are too low and the soundest way to raise the revenues in the long run is to cut the rates now.

Kennedy added: “Cutting taxes now is not to incur a budget deficit, but to achieve the more prosperous, expanding economy which can bring a budget surplus.”

And then the high-growth, low-inflation Reagan tax cuts that spawned a nearly 30-year economic boom.

Following the Laffer curve, and his tax cut program in the first term, President Trump awarded Mr. Laffer the Presidential Medal of Freedom.

Without question, Mr. Laffer also deserves a Nobel Prize, but the left-leaning economics profession won’t give one to him.

Now America needs a supply-side comeback because so many Republicans seem to have forgotten the message of the Laffer Curve. And unfortunately JFK’s Democratic Party no longer exists.

Mr. Trump’s pro-growth tax cuts combined with the AI revolution, though, would surely drive economic growth above 3 percent per year.

Chip Somodevilla/Getty Images

Ignoring this, congressional Republicans are depriving themselves of about $2.5 trillion in revenues that would conquer the budget deficit and reduce the debt burden on the economy by bending down the debt to GDP ratio.

The Trump Council of Economic advisers is predicting more than 4 million new jobs, and more than $9,000 a year for a typical middle-class family.

So the administration is still traveling along the Laffer curve.

And a Wall Street Journal feature interview with Mr. Laffer quotes him on Mr. Trump’s “one, big, beautiful bill,” saying it will create “economic prosperity like you’ve never seen.”

Mr. Laffer is right. And for Capitol Hill Republicans, this should be a teaching moment.

From Mr. Kudlow’s broadcast on Fox Business Network.