Will Friday Diplomacy With the Islamic Republic Lead to a Military Strike?

By BENNY AVNI

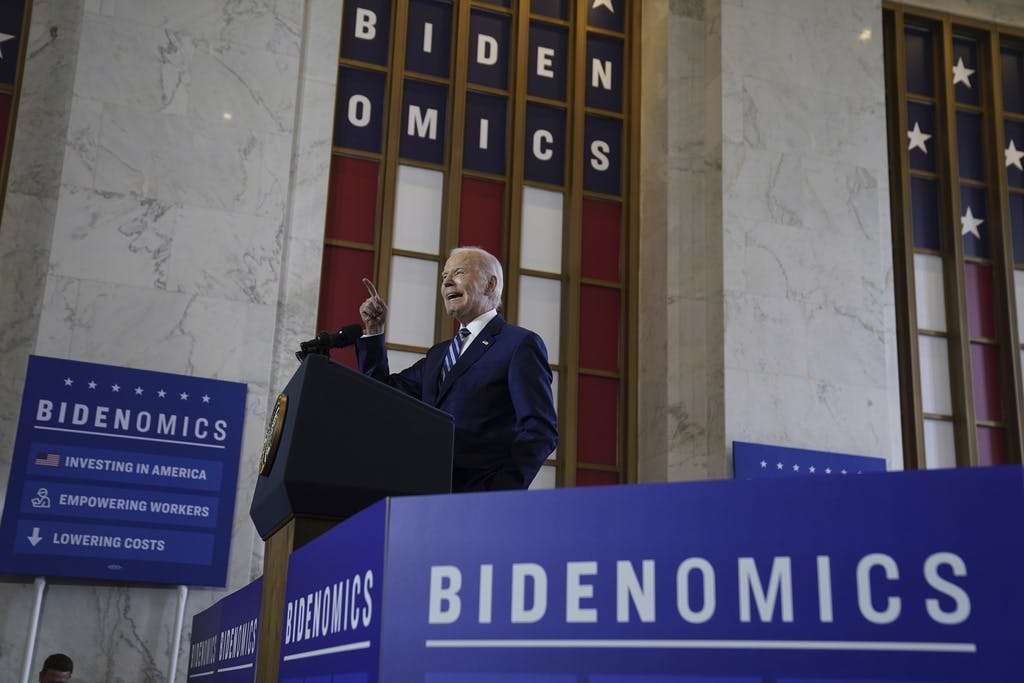

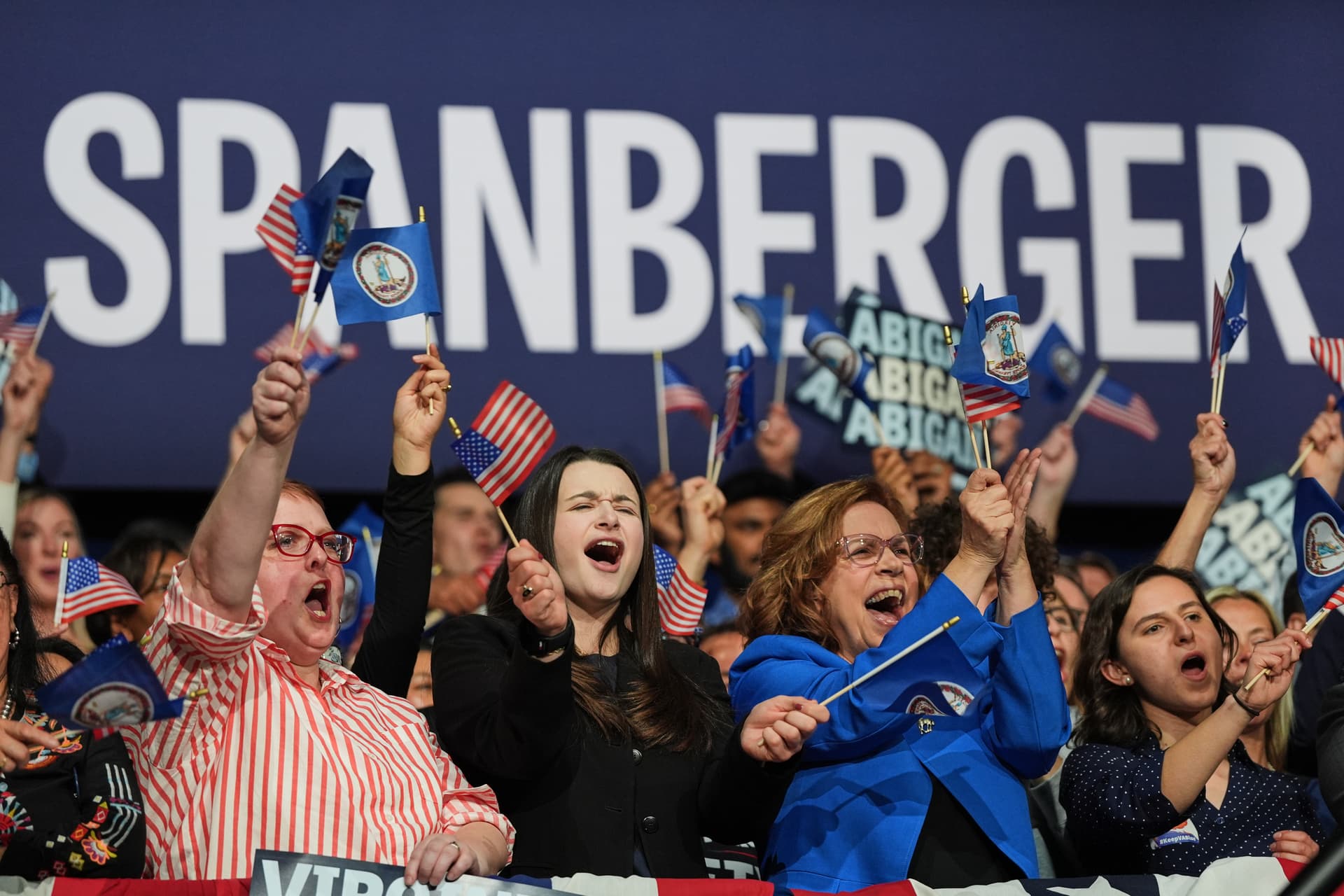

|Changes in household net worth may prove a better index of voters’ economic discontent — or contentment — than the oft-used unemployment or total income figures.

Already have a subscription? Sign in to continue reading

$0.01/day for 60 days

Cancel anytime

By continuing you agree to our Privacy Policy and Terms of Service.

By BENNY AVNI

|

By BRADLEY CORTRIGHT

|

By CARLOS SOUSA

|

By LUKE FUNK

|

By NOVI ZHUKOVSKY

|

By BRADLEY CORTRIGHT

|

By MATTHEW RICE

|

By JOTAM CONFINO

|