Kim Jong Un Glorifies North Korean Lives Lost in Ukraine War at Opening of Luxury Apartment Complexes at Pyongyang

By DONALD KIRK

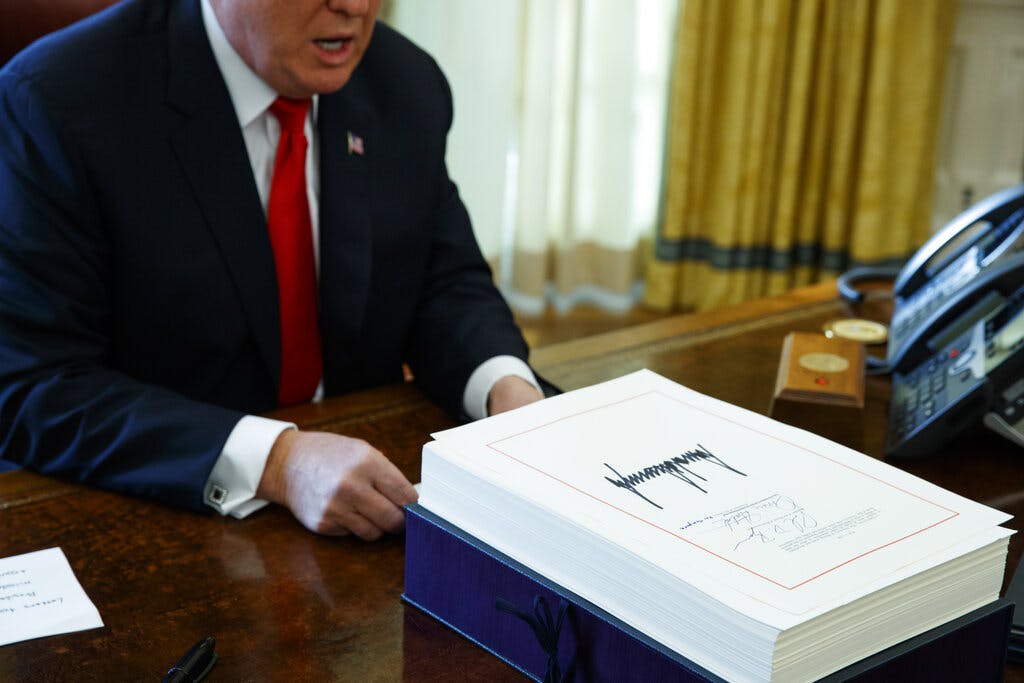

|Under President Biden, federal spending has exploded to more than $6 trillion. Washington doesn’t have a revenue problem. It has a problem of runaway spending.

By DONALD KIRK

|

By BRADLEY CORTRIGHT

|

By GEORGE WILLIS

|

By MATTHEW RICE

|

By JOSEPH CURL

|

By MARIO NAVES

|

By BERNARD-HENRI LÉVY

|

By HOLLIE McKAY

|Already have a subscription? Sign in to continue reading

$0.01/day for 60 days

Cancel anytime

By continuing you agree to our Privacy Policy and Terms of Service.