Job Market Too Strong for the Fed’s Policy Makers

Robust hiring was seen as a factor keeping inflation elevated and was a key reason why they expect to raise interest rates this year more than they had previously forecast.

WASHINGTON — Federal Reserve officials suggested at their most recent meeting that a continuing streak of robust hiring could keep inflation elevated and was a key reason why they expected to raise interest rates this year more than they had previously forecast.

In the minutes of their mid-December meeting released Wednesday, the officials also underscored that a slowdown in their rate hikes — to a half-point increase from four three-quarter point hikes in a row — “was not an indication of any weakening” in their resolve to bring inflation back down to their 2 percent target.

Nor did the smaller increase signal “a judgment that inflation was already on a persistent downward path,” the minutes said. Instead, the risks remained that inflation could stay higher than expected, officials said.

That message reflected concern that Wall Street traders were too optimistic that the Fed would soon suspend its rate hikes and even cut them later this year. Such a “misperception,” the minutes indicated, would complicate the Fed’s drive to lower inflation.

This would occur if bullish traders sent stocks up and bond yields down, which would counter the Fed’s efforts to cool the economy.

Overall, the minutes showed that Fed officials remained determined to keep rates high to quell inflation and have taken little comfort from inflation’s decline from a peak of 9.1 percent in June to 7.1 percent in November.

The hard-line message caused the stock market to tumble after the Fed announced its latest rate hike and projected that there would be more hikes this year than had been expected.

“The minutes stress that the Fed is going to reduce inflation at the risk of hurting the labor market and the broader economy,” said the chief United States economist at Oxford Economics Ryan Sweet.

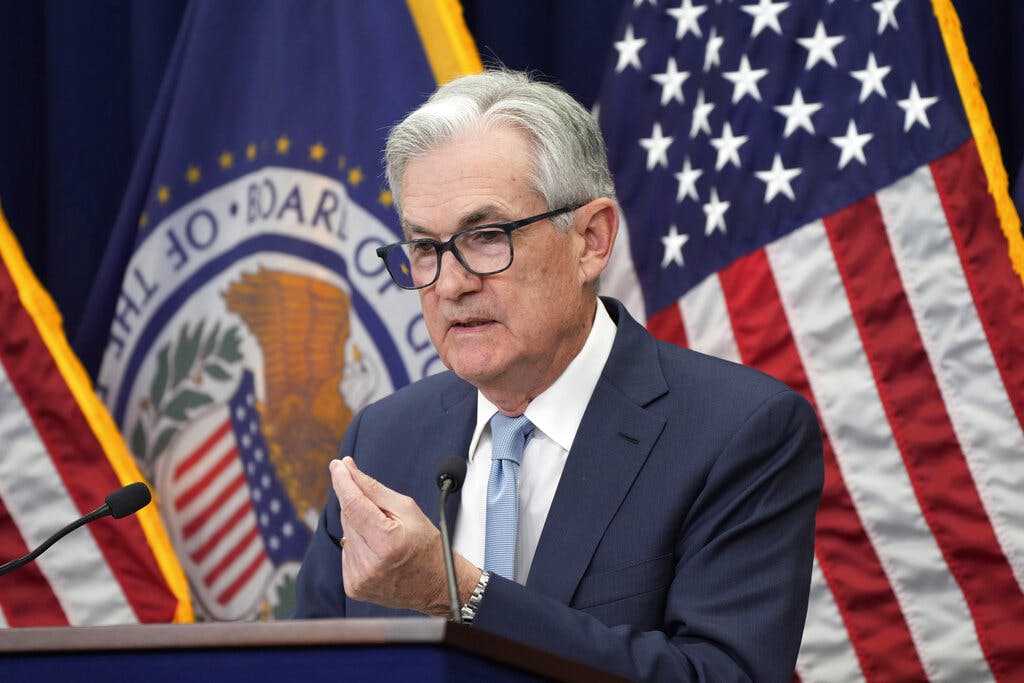

At a news conference after last month’s meeting, the Fed chairman, Jerome Powell acknowledged that inflation had been subdued in October and November. Yet he stressed that “substantially more evidence” of declining inflation would be needed for the Fed to pause its rate hikes.

“We have a long way to go,” Mr. Powell said, “to get to price stability.”

The Fed’s higher rates have increased the costs of mortgages, auto loans and other consumer and business borrowing.

In a set of quarterly economic projections they issued after the December 14 meeting, the officials said they expected to raise their benchmark rate to a range of 5 percent to 5.25 percent and to keep it there until the end of the year. That was a quarter-point higher than financial markets had expected.

The policymakers also forecast that inflation would end this year at a higher level than it had projected in September, despite signs that price increases have slowed in recent months.

Officials predicted that inflation, according to its preferred measure, would be 3.1 percent by the end of this year, up from 2.8 percent in its September estimates.

The Fed’s 19 policymakers were unified in projecting a higher rate this year, with 17 of them forecasting a rate of at least 5 percent to 5.25 percent and just two coming in slightly below.

Many economists have warned that the central bank’s aggressive rate hikes will plunge the economy into recession this year. The Fed officials predicted last month that the unemployment rate would rise to 4.6 percent this year from 3.7 percent now — a pace that typically has coincided with a recession.

Yet so far, the job market has remained resilient. On Wednesday, the government reported that the number of available jobs in November stayed near the elevated level of the previous month, a sign that businesses were still determined to hire despite 18 months of high inflation and rising interest rates.

Also on Wednesday, the president of the Federal Reserve Bank of Minneapolis, Neel Kashkari, said he supported lifting the Fed’s rate to about 5.25 percent to 5.5 percent. That is higher than most of his colleagues favor and a full point above its current level.

“While I believe it is too soon to definitively declare that inflation has peaked, we are seeing increasing evidence that it may have,” Mr. Kashkari wrote on the Minneapolis Fed’s website. “In my view, however, it will be appropriate to continue to raise rates at least at the next few meetings until we are confident inflation has peaked.”

Mr. Kashkari also said he favors leaving the Fed rate at the 5.4 percent level to assess what impact higher rates have had on the economy. Yet he added that if progress in reducing inflation fades, leaving price gains higher for longer, he would support raising the Fed’s rate “potentially much higher.”