Homeland Security Shutdown Looks Set To Drag On, Bringing New Headaches for Air Travelers

By JOSEPH CURL

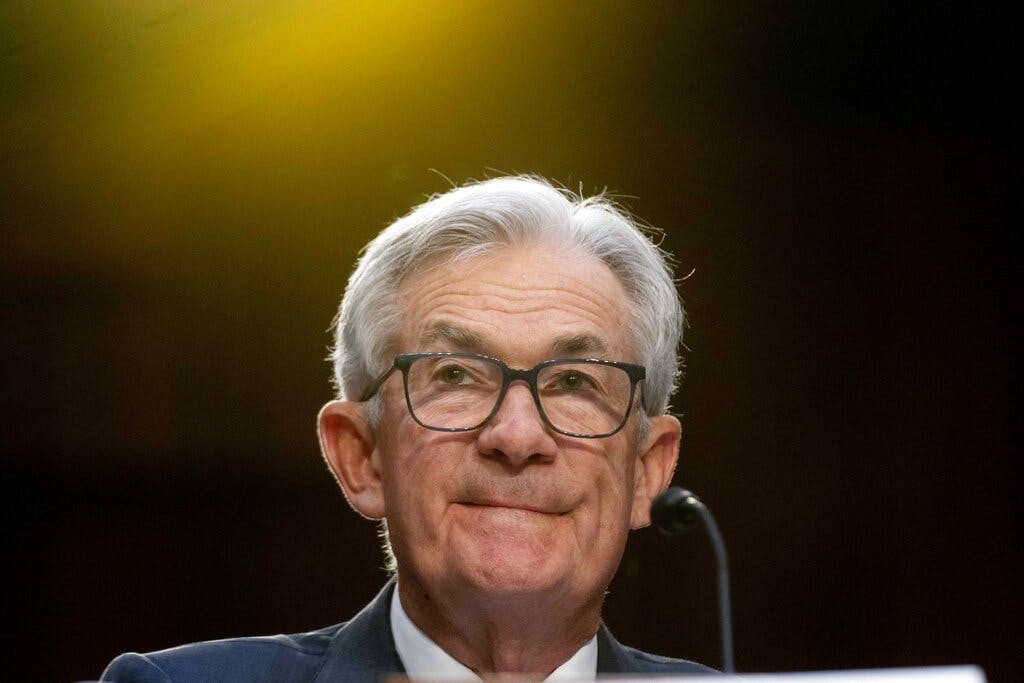

|Ahead of Wednesday’s Federal Reserve meeting, what’s on the chairman’s mind?

Already have a subscription? Sign in to continue reading

By JOSEPH CURL

|

By VERONIQUE de RUGY

|

By ELYSA GARDNER

$0.01/day for 60 days

Cancel anytime

By continuing you agree to our Privacy Policy and Terms of Service.