The ‘Hidden Issue’ of 2024: Rent

The cost of housing could be behind soft support for President Biden among key Democratic voting blocs.

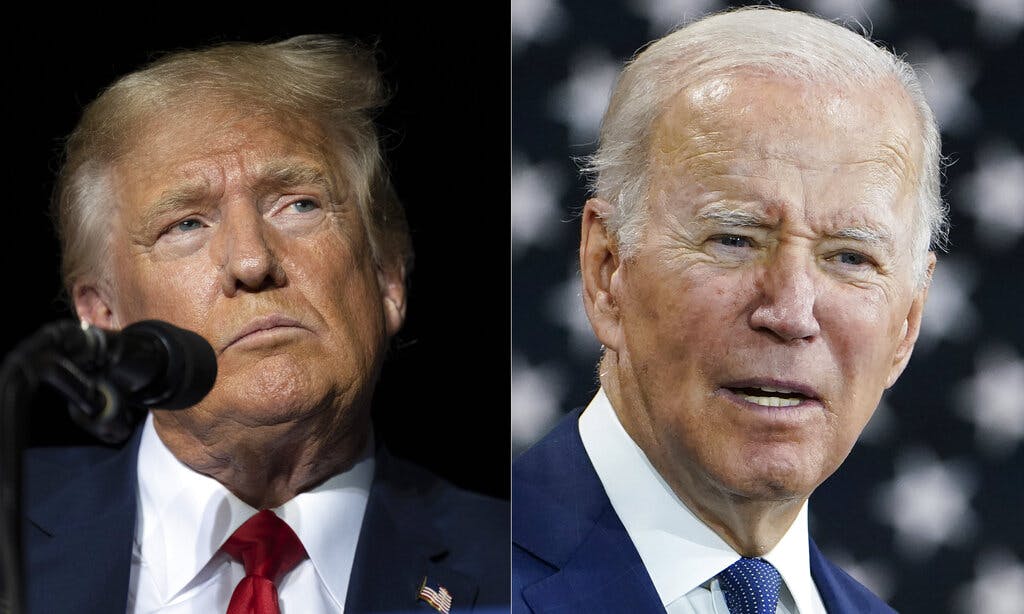

With a new survey showing President Biden trailing President Trump in key swing states, Democrats are sounding alarms about Mr. Biden’s electability. Political handicappers and commentators, meanwhile, are looking past what is emerging as what one analyst calls the “hidden issue” that could end up losing the election for Mr. Biden — the cost of rent.

The latest survey from the New York Times and Siena College, which found that Mr. Biden trails Mr. Trump in key swing states, set off a new round of speculation around Mr. Biden’s electability.

A top Democrat strategist for President Obama, David Axelrod, for one, appears to be suggesting it’s time for Mr. Biden to step aside, saying the president needs to consider whether running again is “in HIS best interest or the country’s.”

The president “is justly proud of his accomplishments. Trump is a dangerous, unhinged demagogue whose brazen disdain for the rules, norms, laws, and institutions or democracy should be disqualifying,” Mr. Axelrod said. “But the stakes of miscalculation here are too dramatic to ignore.”

While polling a year out from an election is not typically predictive of the final outcome — some polls ahead of the 2012 election showed Senator Romney beating Mr. Obama by 2 points — they do serve as a snapshot of the public opinion in a particular moment.

In the current moment, Mr. Biden’s bad showing against Mr. Trump appears to stem from relatively weak support among some core Democratic constituencies, namely Black voters, Hispanic and Latino voters, and young voters.

In the Times’s battleground survey, Mr. Biden had 71 percent support among Black voters, 50 percent support among Hispanic voters, and 47 percent support among voters younger than 30.

This translates into a 49-point lead over Mr. Trump among Black voters, an 8-point lead among Hispanic voters, and a 1-point lead among young voters.

For reference, a Pew Research analysis of Mr. Biden’s 2020 presidential election victory found that Mr. Biden carried 92 percent of the Black vote, 59 percent of the Hispanic vote, and 59 percent of the vote of those younger than 30.

A political scientist at the University of Massachusetts Lowell and the associate director at the Center for Public Opinion there, John Culverius, tells the Sun that there is some reason to doubt that this trend will hold among younger voters.

“This would be a really rapid shift over time for that to happen,” Mr. Culverius says. “Every election expert would be shocked to see a result this close among young voters.”

The main reason for this is that younger voters are less likely to pay close attention to the news and are harder to reach than older voters, even in online surveys.

Mr. Culverius also stressed that Mr. Trump is “commanding less attention now because he is not president” and that voters will likely be reminded of what they don’t like about Mr. Trump, like his insistence that he won the 2020 election, as the election draws nearer.

There is, though, a hidden issue in the race, in Mr. Culverius’s opinion, and it’s an issue that ties Black, Hispanic, and young voters together in a material sense: These are the voters least likely to own a home.

“If there’s a hidden issue that will shape this race — especially in a way that hurts Joe Biden — it’s housing costs,” Mr. Culverius says. “No pollster is asking about it, but when you have an open-ended question, it’s near the top three issues in almost every state.”

According to Census data, Black and Hispanic Americans are less likely to own a home than Americans of any other race or ethnicity. The 2020 Census found that Black Americans had the lowest rate of home ownership at 42.1 percent, and Hispanic and Latino Americans were second-lowest at 47.5 percent.

Younger American adults are also less likely to own a home, with Census data indicating that 39 percent of Americans younger than 35 years of age own a home. The next oldest cohort, Americans between 35 and 44, has a homeownership rate of 62.2 percent.

While the Times’s survey didn’t ask specifically about rent prices and inflation, it did ask whether social or economic issues would be the deciding factor for different groups of voters in 2024 and, perhaps unsurprisingly, Black, Hispanic, and young Americans were more likely to cite economic issues as being decisive in their voting intent.

The survey found that 53 percent of white voters said economic issues would be more important than social issues in their decision of who to vote for in 2020. Some 65 percent of Black voters and 66 percent of Hispanic voters said the same.

Young voters also cited economic issues as driving their vote at a higher rate than any other age group, with 62 percent of voters younger than 30 citing “jobs, taxes, or cost of living” as driving their vote.

While many traditional economic indicators suggest an improving economy, the median rent in America’s 50 largest cities is 24 percent higher than it was in 2019, according to Realtor.com’s October rent report, translating to hundreds of dollars less a month for renters.

The report found that the median rent for a two-bedroom in America’s top 50 cities is $1,747, which is $316 more expensive on a monthly basis than it was in 2019.

In conversation with the Sun, Mr. Culverius says that “no politician, no political scientist, and no pollster has clocked the impact of housing costs on this election.”

“It’s consistently showing up as one of the most important issues to voters and no politician has a popular plan to address it,” he says.

The price of purchasing a home has also skyrocketed since 2019. According to the Saint Louis Federal Reserve, the average price for a home sold in America has risen to more than $514,000 from about $385,000 in the fourth quarter of 2019.

Interest rate hikes have also affected the affordability of buying a home, with monthly mortgage payments increasing to more than $2,500 in most metro areas, according to a report by the Joint Center for Housing Studies at Harvard University.

While this trend has probably kept many Americans from buying new homes, renters are consistently affected more by economic hardship than homeowners. A recent report by the Bank of America Institute confirmed that this trend held true through the recent years of rent inflation.

“Bank of America internal data confirms a wedge has opened between the spending of renters and homeowners,” the report reads. “Renters’ spending appears to have been sapped by rent inflation, while homeowners have been somewhat insulated from higher interest rates so far.”