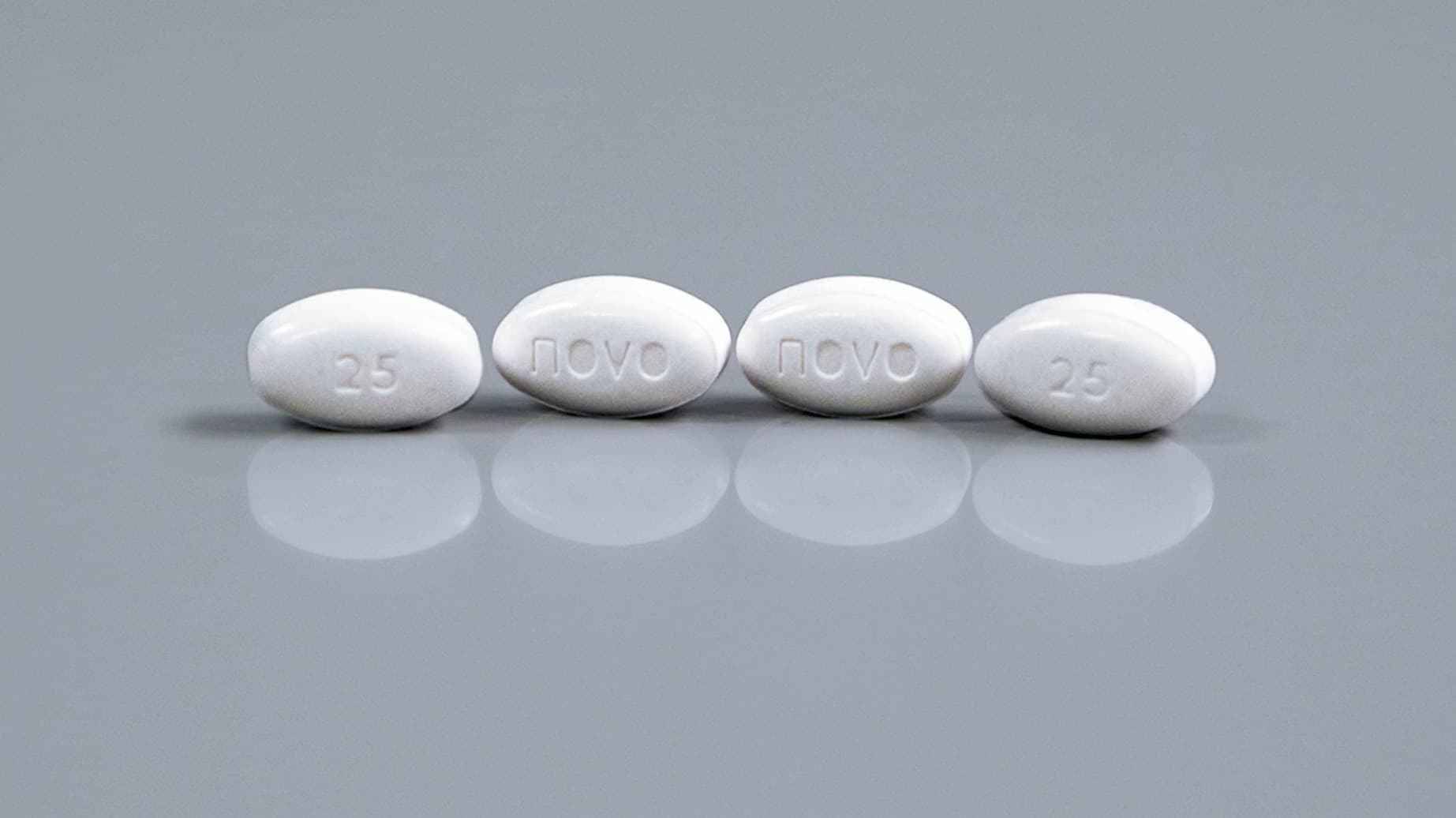

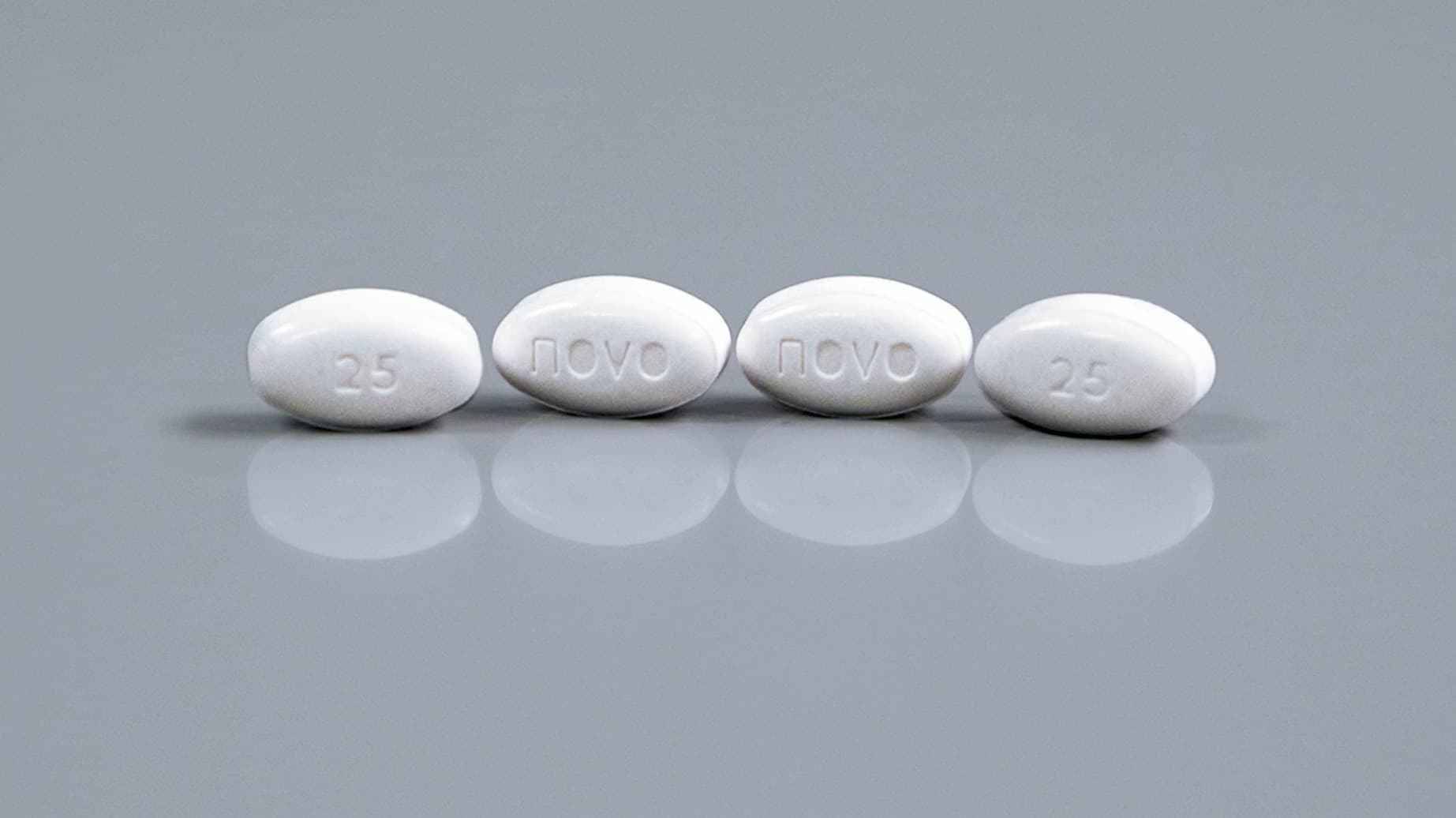

Him & Hers in Hot Water Over Knockoff Version of Wegovy Weight Loss Pills

By LUKE FUNK

|If the goal is truly to improve our fiscal situation, as defined by reducing the ratio of debt to GDP or reducing projected gaps between revenue and spending, increasing tax revenue should be limited to the minimum politically possible.

Already have a subscription? Sign in to continue reading

By LUKE FUNK

|

By BRADLEY CORTRIGHT

|

By THE NEW YORK SUN

|$0.01/day for 60 days

Cancel anytime

By continuing you agree to our Privacy Policy and Terms of Service.