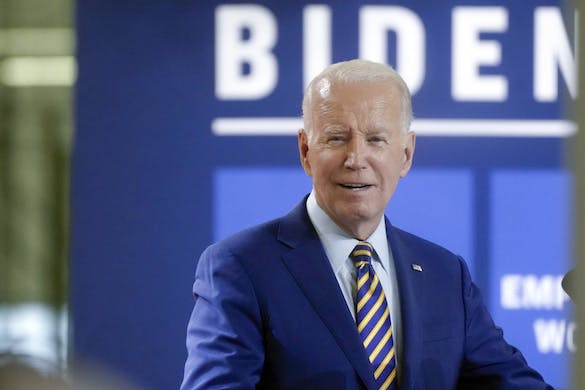

Democrats Push Companies To Pass Tariff Refunds Along to Consumers, but Trump Administration Balks at Starting the Process

By LUKE FUNK

|The newly unveiled budget, which includes taxing unrealized asset gains, could face scrutiny as the Supreme Court considers a separate case that argues the Sixteenth Amendment prevents taxing unrealized income.

Already have a subscription? Sign in to continue reading

$0.01/day for 60 days

Cancel anytime

By continuing you agree to our Privacy Policy and Terms of Service.

By LUKE FUNK

|

By JOTAM CONFINO

|

By M.L. NESTEL

|

By BRADLEY CORTRIGHT

|

By JOTAM CONFINO

|

By JAMES BROOKE

|

By NOVI ZHUKOVSKY

|

By MATTHEW RICE

|