Hamas, Defying Trump, Eyes Keeping Control of Gaza

By THE NEW YORK SUN

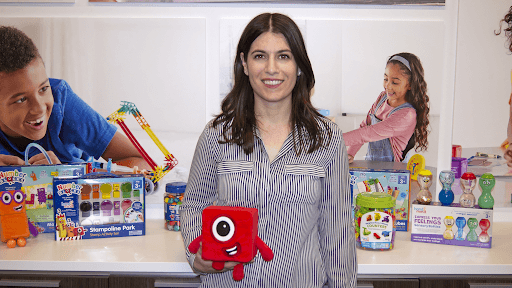

|Learning Resources says Trump’s tariffs amount to taxation without representation.

Already have a subscription? Sign in to continue reading

$0.01/day for 60 days

Cancel anytime

By continuing you agree to our Privacy Policy and Terms of Service.

By THE NEW YORK SUN

|

By CAROLINE McCAUGHEY

|

By JOSEPH CURL

|

By MATTHEW RICE

|

By LUKE FUNK

|

By JOTAM CONFINO

|

By NOVI ZHUKOVSKY

|

By BRADLEY CORTRIGHT

|