‘The Trembling Hand’ Provocatively Calls Out the Romantic Poets for Perpetuating Racist Tropes

By CARL ROLLYSON

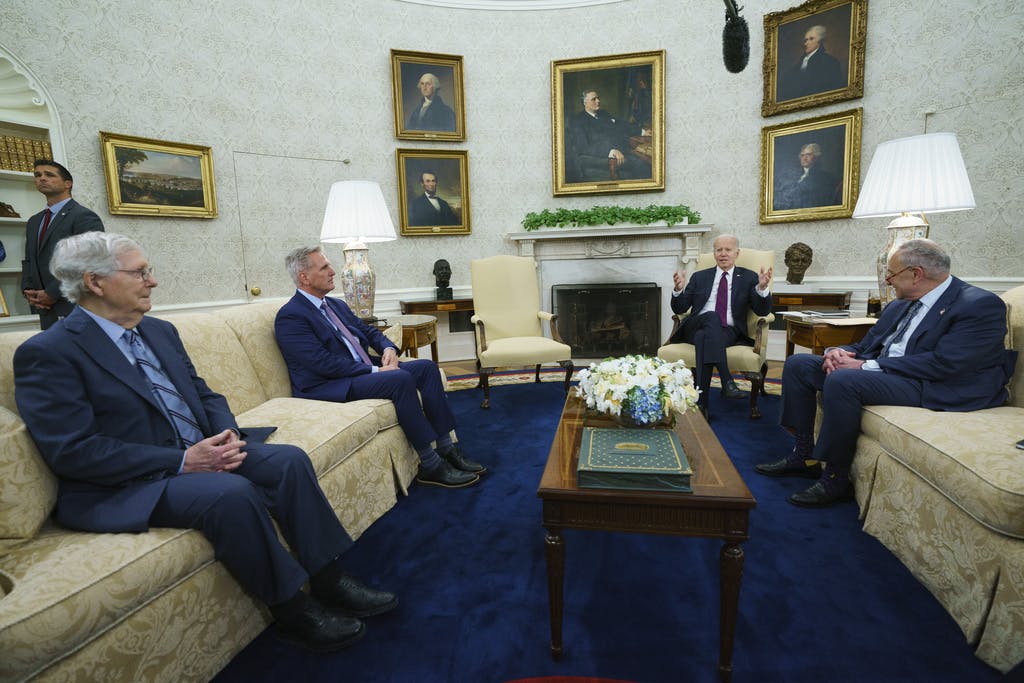

|Time to pivot to the budget from fight at the Fed.

Already have a subscription? Sign in to continue reading

$0.01/day for 60 days

Cancel anytime

By continuing you agree to our Privacy Policy and Terms of Service.

By TOM TEODORCZUK

|