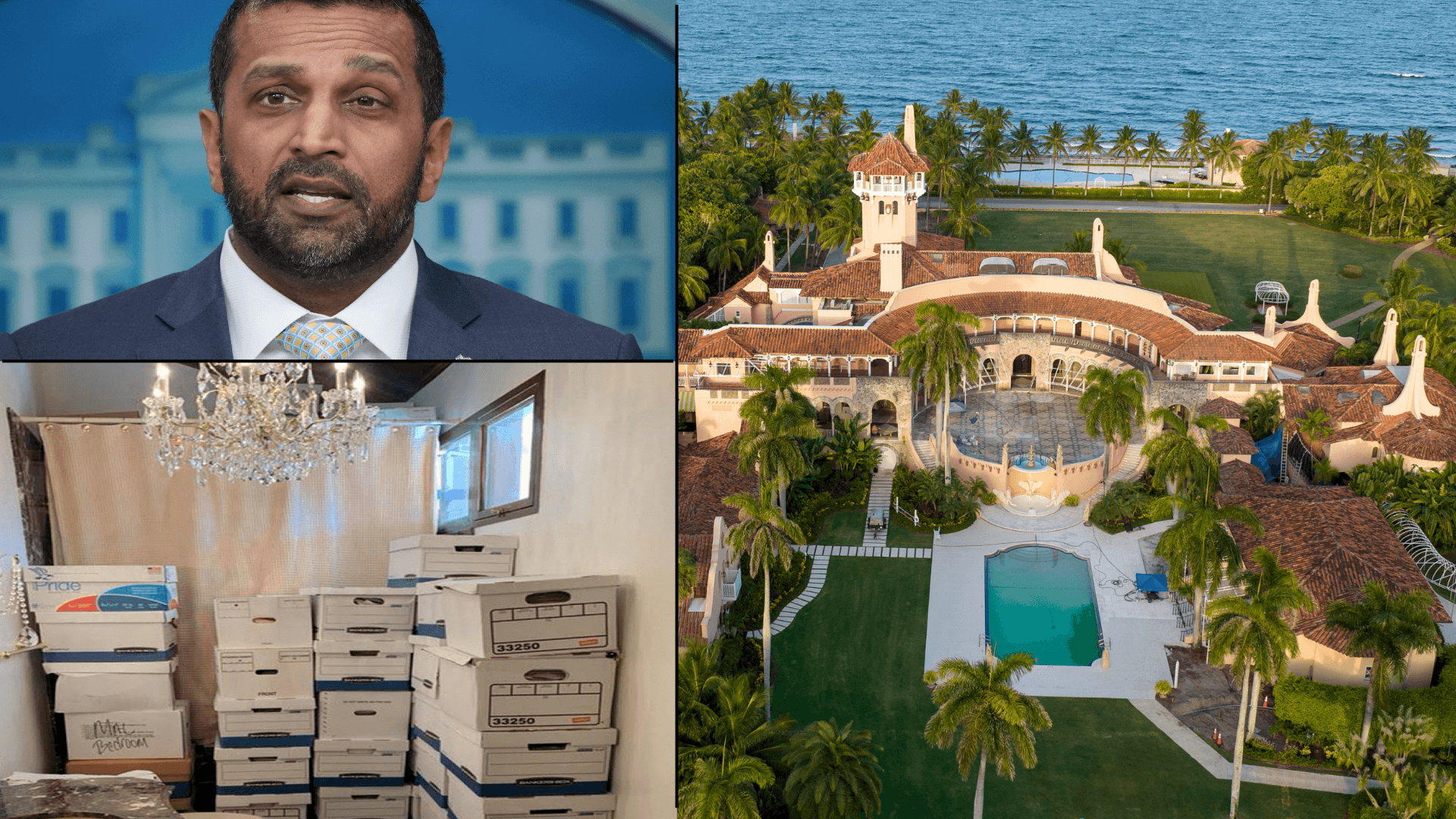

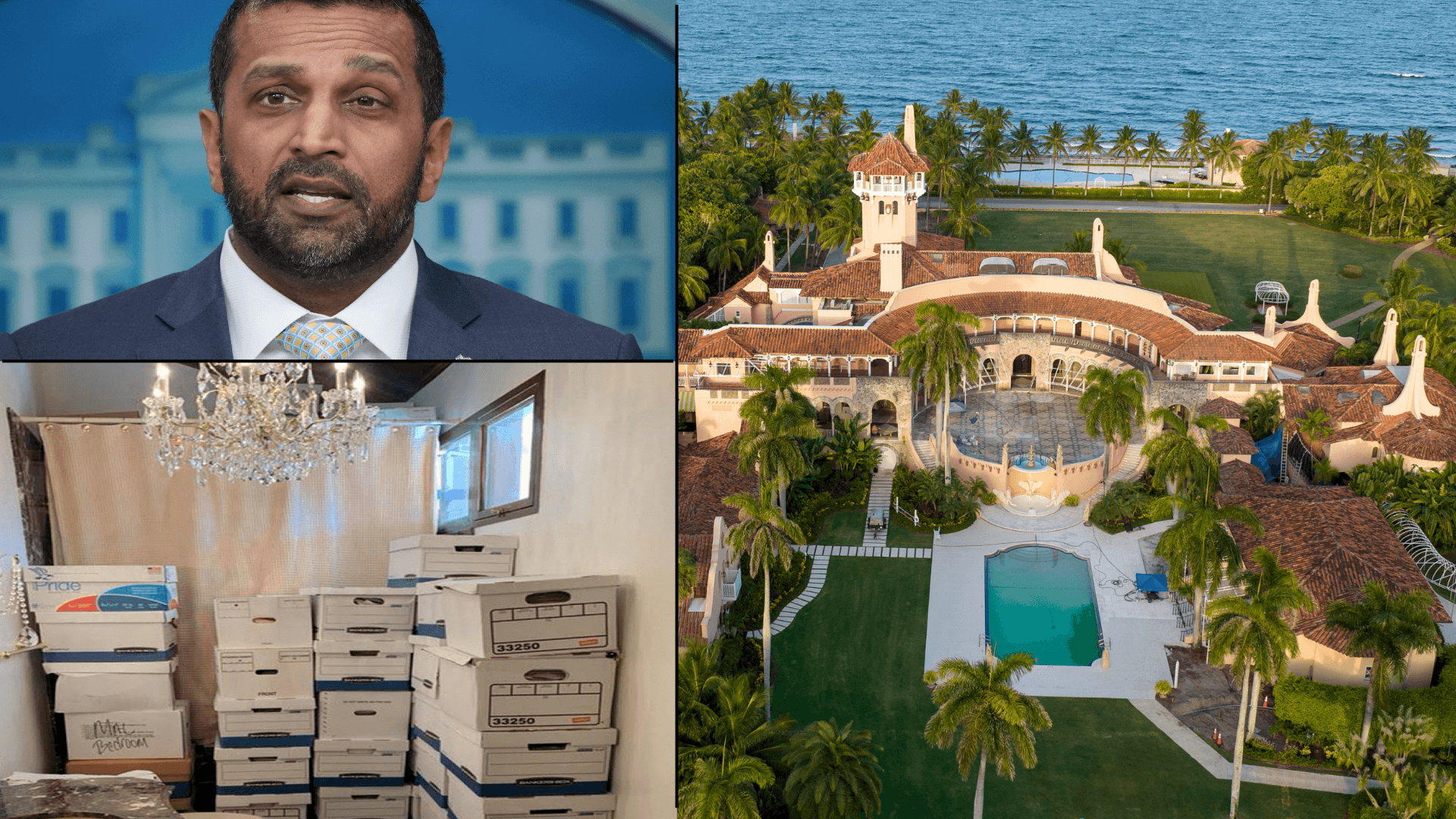

Exclusive: FBI Staffers Fired for Role in Mar-a-Lago Probe Were Assigned to Espionage Unit That Investigated Iranian Threats in America, Sources Say

By DANIEL EDWARD ROSEN

|Shares of Nielsen soared more than 21 percent before the market open.

Already have a subscription? Sign in to continue reading

$0.01/day for 60 days

Cancel anytime

By continuing you agree to our Privacy Policy and Terms of Service.

By DANIEL EDWARD ROSEN

|

By A.R. HOFFMAN

|

By HOLLIE McKAY

|